Some Information

Key Information

- Time

30 Nov 2023

- Location

Beijing, China

- Organizer

Visa

- Category

Coshine News

Coshine Software was invited to participate in the "2023 Visa China Cross-Border Financial Payment Innovation Forum."

Discussing Business Payments Together

The "2023 Visa China Cross-Border Financial Payment Innovation Forum" was successfully held in Beijing, showcasing Visa's innovative technologies and comprehensive solutions in the field of cross-border business payments. The event brought together Visa's Asia-Pacific product experts, industry specialists, and over a hundred leaders from financial institutions, payment service providers, technology companies, and more. Participants shared insights and discussed the latest trends, challenges, and opportunities in cross-border financial payments. As a Visa payment processor, Coshine Software was honored to participate in this summit.

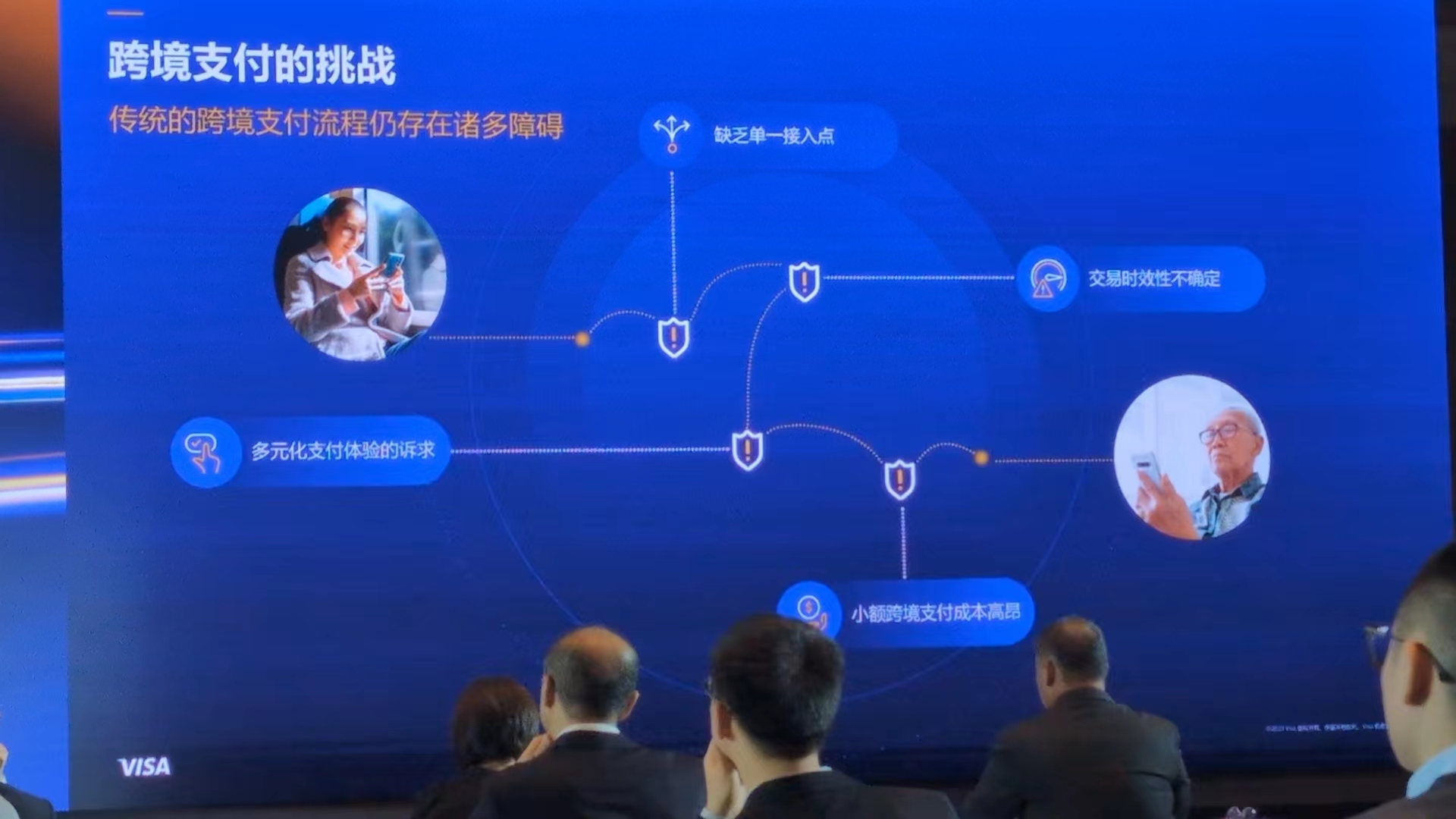

In today's globalized business environment, cross-border financial payment innovation has become a significant force driving economic development. Approximately 800 million people receive around $800 billion in remittances annually from global movements, indicating numerous opportunities for business growth in cross-border payments. Moreover, a payment revolution is unfolding globally, especially in the Asia-Pacific region, with emerging digital solutions such as instant transactions and mobile wallets, catering to evolving customer expectations and transforming cross-border fund flows.

In recent years, Visa has been committed to digitizing business payments and fund flows, providing support to financial institutions, fintech industry pioneers, businesses, and the real economy. Responding to local demands, Visa has introduced a "One-Stop Visa Business and Fund Flow Business" for its Chinese partners, aiding small and medium-sized enterprises in enhancing operational and fund flow capabilities.

Yin Xiaolong, President of Visa China, stated in his concluding remarks, "As one of Visa's three global pillars of business, we will continue to invest in the network of Visa Business and Fund Flow, iterate our products, and look forward to co-creating innovative business models with domestic customers and partners to seize the growth opportunities in cross-border payment business."

Wang Zhiyun, General Manager of Visa's Business and Fund Flow Business in Greater China, expressed, "Visa's business and fund flow business will pay more attention to addressing the pain points of local enterprises. We collaborate with financial institution clients and fintech companies to jointly provide products and services to meet the needs of small and medium-sized enterprises, solving their complex expense management and reconciliation issues. Additionally, through the Visa network, we provide global fund flow capabilities, helping exporters receive and remit funds through various foreign exchange options for more efficient global fund flow in corporate payments."

To demonstrate its commitment to the Chinese market and drive the transformation of cross-border payments, Visa participated in the inaugural "China International Supply Chain Expo" (referred to as "Chain Expo") held in Beijing. At the expo, Visa showcased its comprehensive global digital business payment solutions, including Visa digital business payment solutions and Cybersource risk management solutions tailored to different business scenarios, needs, and payment risk management, highlighting Visa's development philosophy of openness, innovation, flexibility, and security in the rapidly changing digital business era.

About Coshine Software:

Established in 2003, Shanghai Coshine Software Co., Ltd. is one of Visa's payment processors. Coshine Software is dedicated to providing a range of innovative payment processing services, including card issuing, acquiring, payment gateway, and risk control, for financial institutions, the fintech industry, businesses, and the real economy. Focusing on facilitating the digitization of payments and fund flows, Coshine Software offers local and global customers efficient and secure payment experiences.